CFS Index

04.02.2021

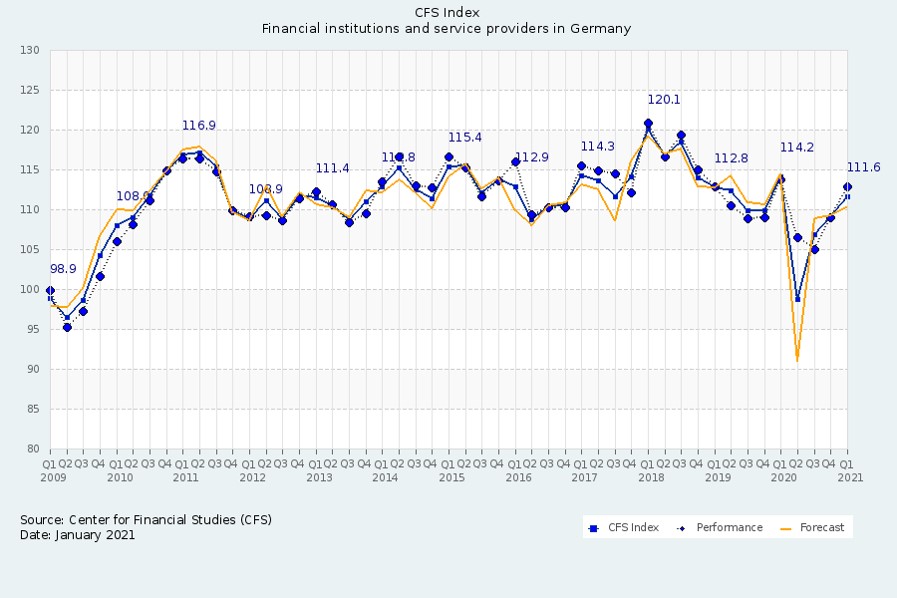

CFS Index clearly rises for the second time in succession

(Survey conducted 20-27 January 2021 for the results of the fourth quarter 2020)

Undeterred by the second wave of Covid-19, the sentiment of the financial sector is improving, certainly due in part to hopes raised by the newly developed vaccines. As a result, the CFS index, which measures the business climate of the German financial sector on a quarterly basis, stabilised in the second half of 2020 following an initial slump at the start of the Covid 19 crisis. In the fourth quarter of 2020, it rises by +2.5 points to 111.6 points and is only 2.6 points below the previous year’s level, which was shortly before the outbreak of the pandemic.

This positive development in the financial sector is based on rising revenue growth in the fourth quarter, especially among the service providers, who also report a substantial increase in earnings growth. Both groups also report positive investment growth and the financial institutions are hiring again for the first time in several years. However, the positive sentiment is clouded by lower earnings growth among the financial institutions in the fourth quarter. In addition, both groups are rather cautious about their expected revenue and earnings growth in the current quarter and the financial institutions expect to return to their long-standing pattern of job cuts. In this regard, the service providers are more optimistic and expect employee numbers to rise.

“Optimistic service providers, selective investments and recruitment: the technological transformation of the financial industry is clearly gathering pace again after slowing down for several quarters due to the Covid-19 pandemic,” comments Professor Andreas Hackethal, Director of the Center for Financial Studies.

In spite of the Covid-19 crisis, the future international importance of the Financial Centre Germany is viewed increasingly positively. With an increase of +3.5 points, the current index value is 118.6 points.

“The topics of networking, sustainability and digitalisation are not only the focus of Frankfurt Main Finance in 2021, but also of Germany Finance, the recently founded working group of German financial centres. The financial centre initiatives from Berlin, Frankfurt, Hamburg, North Rhine-Westphalia and Stuttgart will work closely together to further strengthen Germany as a financial centre in the European and international setting,” explains Gerhard Wiesheu, President of Frankfurt Main Finance.

Financial sector reports positive revenue growth and nears previous year’s level

The surveyed financial institutions and service providers managed to boost their growth in revenues/business volume in the final quarter of 2020, even surpassing their expectations from the last survey, which preceded the second wave of Covid-19. The corresponding sub-index for the financial institutions rises by +1.7 points to 120.3 points and is now just 0.3 points below the previous year’s level. For the service providers, the sub-index rises by +5.9 points to 119.1 points, yet still remains 3.3 points below the previous year’s level. For the current quarter, both groups expect revenue growth to slow down again.

Earnings growth among the financial institutions fell by -2.2 points to 112.6 points in the fourth quarter of 2020, but remains 1.2 points above the previous year’s level. In contrast, the service providers report a significant increase of +12.1 points to 117.4 points. However, their earnings growth is still 5.4 points below the level of a year ago. As for the first quarter of 2021, the financial sector as a whole has more modest expectations.

The growth in investment volume in product and process innovations develops equally positively across both groups in the fourth quarter. The corresponding sub-index rises by +2.2 points to 106.7 points for the financial institutions and by +2.4 points to 105.9 points for the service providers. As a result, the financial institutions are now 1.9 points and the service providers 6.7 points below the previous year’s level. The service providers expect the positive trend in investment volume to continue in the current quarter, while the financial institutions are somewhat cautious.

Financial institutions halt job cuts

Contrary to previous expectations, the financial institutions return to hiring in the fourth quarter of 2020 for the first time in several years. The employee numbers sub-index rises by +9.0 points to 101.3 points, which is 6.8 points up on the level of one year ago. The service providers also report a slight increase in their workforce. The corresponding sub-index rises by +1.5 points to 106.8 points and is a moderate 0.7 points above the level of the previous year. However, in the current quarter the financial institutions expect employee numbers to reduce again slightly. The service providers, on the other hand, expect the positive trend to continue.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.