CFS Index

12.05.2022

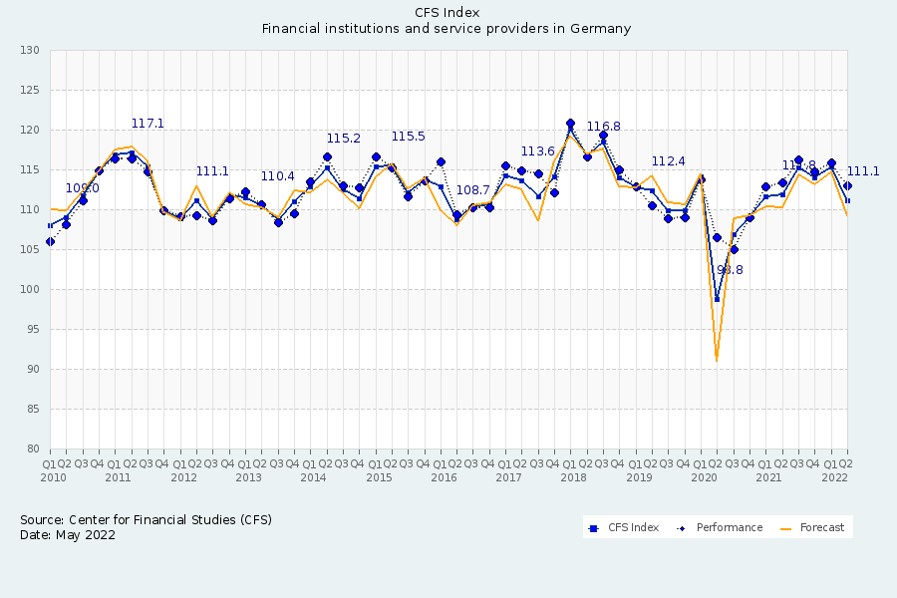

CFS Index falls significantly

(Survey conducted 25 April – 02 May 2022 for the results of the first quarter 2022)

Sentiment in the financial sector has worsened significantly. The CFS Index, which measures the business climate of the German financial sector on a quarterly basis, falls by 4.2 points to 111.1 points in the first quarter of 2022. Compared to the previous year, however, the index value remains at almost the same level (-0.7 points) and continues to demonstrate solid growth. The index has recovered significantly from the pandemic-related slump two years ago. With an increase of +12.3 points, it is clearly above the level shortly after the outbreak of the pandemic.

The downward trend in the first quarter of 2022 is primarily due to reduced growth in revenue and earnings in the entire financial industry. This development was anticipated in the previous quarter. Furthermore, the financial sector is exercising caution in the current quarter. There are encouraging reports of increases in job creation, particularly among service providers. Moreover, the financial institutions report increased growth in investment volume.

"Despite challenging conditions, each and every opportunity for further growth through structural change is being taken advantage of in the industry," Prof. Dr. Rainer Klump, Director of the Center for Financial Studies comments on the results.

Assessment of the future international importance of the Financial Centre Germany improved slightly in the first quarter of 2022. With an increase of 1.2 points, the current index value is 106.7 points. The increase is due to the positive rating of the financial institutions, up +2.8 points.

"The international financial centre Frankfurt as well as strong and globally well-connected regional centres such as Berlin, Hamburg, Munich, Stuttgart or North Rhine-Westphalia are bundling their efforts in the Initiative Germany Finance. A recently published report identifies three core challenges for the German financial system: the sustainable transformation, the digital (r)evolution and the banking and capital markets union. The positive response of the financial institutions shows that Germany is on the right track," says Gerhard Wiesheu, President of Frankfurt Main Finance.

Revenue and earnings growth of financial institutions significantly lower than last year's levels

Growth in revenue in the financial sector fell sharply in the first quarter of 2022. This fall was anticipated in the previous quarter. Financial institutions report a decline of -9.1 points to 112.4 points. This means the financial institutions are -9.8 points below the level of one year ago. The service providers report a decline of -6.4 points to 118.8 points. This means they are now almost at the same level as last year (-0.7 points). The financial sector’s expectations for the second quarter of 2022 remain subdued.

The surveyed financial institutions and service providers also report declines with respect to earnings growth. The corresponding sub-index of the financial institutions falls by -7.7 points to 106.3 points, and at -14.8 points is significantly below the level of the previous year. For the service providers, the sub-index drops by -6.8 points to 115.4 points, gaining +1.0 points compared to a year ago. For the current quarter, both groups continue to anticipate slower earnings growth.

Financial institutions report a rise in growth in investment volume / Service providers maintain the level of the previous quarter

Growth in investment volume in product and process innovations among the financial institutions rises by +5.9 points to 114.9 points and is thus +9.2 points above the prior-year level. The service providers report a slight decline of -0.7 points to 105.1 points. This places the sub-index at -8.6 points below the level of one year ago. For the current quarter, the financial institutions expect a decline, while the service providers expect to maintain their current level.

Job creation above prior-year level

As previously expected, the financial institutions report a slight increase in employee numbers for the first quarter. The employee numbers sub-index rises by +1.0 points to 105.1 points and is thus +9.8 points above the level of one year ago. The service providers also report an increase in their employee numbers. The corresponding sub-index increases +5.8 points to 116.5 points, representing a gain of +10.6 points on the previous year. For the current quarter, both groups expect weaker growth in employee numbers.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.

In case of further questions, please contact:

Prof. Dr. Rainer Klump

Center for Financial Studies

House of Finance

Goethe-Universität Frankfurt

E-Mail: klump(at)wiwi.uni-frankfurt.de