CFS Index

11.05.2021

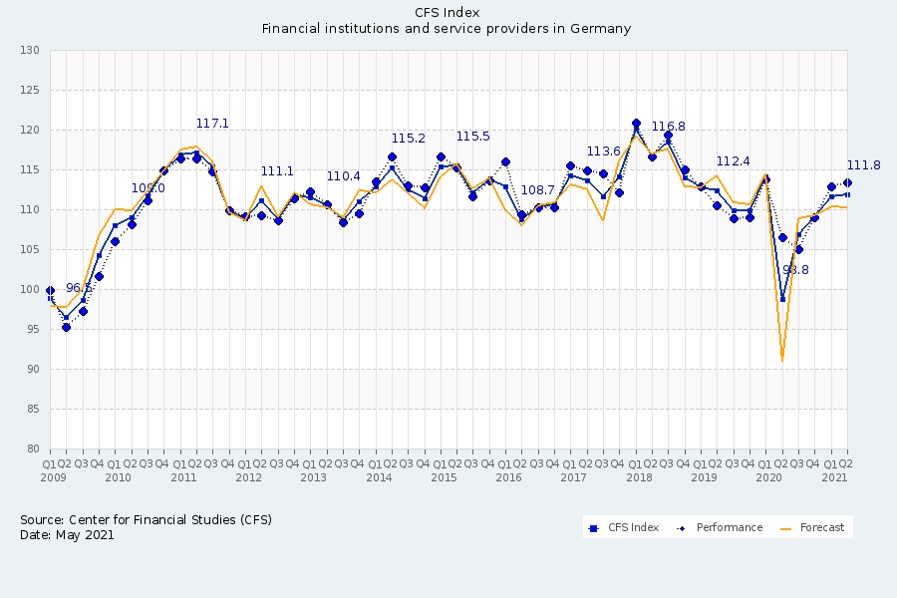

CFS Index remains stable with a slight upward trend

(Survey conducted 29 April – 4 May 2021 for the results of the first quarter 2021)

The financial sector remains in positive spirits. The CFS index, which measures the business climate of the German financial sector on a quarterly basis, rises by +0.2 points to 111.8 points in the first quarter of 2021. With a plus of 13.0 points, it is significantly above the level of one year ago, in the early days of the pandemic.

This positive development is primarily based on a sharp rise in earnings and slight revenue growth among the financial institutions and high investment growth among the service providers. By contrast, the service providers report a decline in earnings growth. In addition, the financial institutions have been shedding jobs for two years now. After a brief hiatus in the fourth quarter of 2020, this trend is now continuing at a faster pace, and this also applies to the current quarter.

“The industry is gearing up for the post-pandemic period. Monetary and financial policy have succeeded in keeping the market environment stable so far. However, risks such as insolvencies, inflation and political instability still loom large,” comments Professor Rainer Klump, Director of the Center for Financial Studies.

The future international importance of the Financial Centre Germany continues to be viewed increasingly positively. With a slight increase of +0.4 points, the current index value stands at 119.0 points.

"A clear sign of the importance of Germany as a financial centre is the excellent rating of Frankfurt am Main in an international comparison as well as the most important financial centre in continental Europe: In the current Global Financial Centres Index, Frankfurt ranks ninth worldwide. The German financial centres Stuttgart, Hamburg, Berlin and Munich have also made it into the top 50 – a development that will certainly continue thanks to the financial centre initiatives, including Frankfurt Main Finance and Germany Finance," comments Gerhard Wiesheu, President of Frankfurt Main Finance.

Revenue, earnings and investment growth significantly above the previous year’s level at the start of the pandemic

The surveyed financial institutions and service providers successfully boost their growth in revenues/business volume in the first quarter of 2021 and clearly surpass their expectations from the previous quarter. The corresponding sub-index for the financial institutions rises by +2.0 points to 122.2 points and, at +9.8 points, is significantly above the previous year’s level. For the service providers, the sub-index rises by +0.4 points to 119.5 points and is a whole +10.9 points above the level of one year ago. Regarding the current quarter, both groups expect to see slight declines.

Strong earnings growth among financial institutions / Slight decline for service providers

The earnings growth of the financial institutions rose by +8.5 points to 121.1 points in the first quarter of 2021. At +17.8 points, this is a huge year-on-year increase. By contrast, the service providers report a decline of -2.9 points to 114.5 points. Nevertheless, their index value is +8.1 points above the level of a year ago. For the second quarter of 2021, the expectations of the financial institutions are far more modest, while the service providers expect to maintain their level.

Service providers significantly increase growth in investment volume

The growth in investment volume in product and process innovations of the financial institutions saw a slight decline of -1.0 points to 105.7 points. Conversely, the service providers report a strong increase in growth. The corresponding sub-index climbs +7.8 points to 113.7 points. This is also well above the previous year’s level for both groups. Looking ahead to the current quarter, the financial institutions do not expect any change, while the service providers anticipate a slight decline.

Return of job cuts at the financial institutions

As previously expected, the financial institutions revert to cutting jobs in the first quarter of 2021. The employee numbers sub-index falls by -6.0 points to 95.3 points and is now at the same level as a year ago. The service providers report a slight slowdown in the growth of their workforce. The corresponding sub-index falls by -0.8 points to 106.0 points, but at +0.5 points is still slightly above the level of a year ago. For the current quarter, the financial institutions anticipate even heavier job cuts. The service providers, on the other hand, foresee a positive development.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.