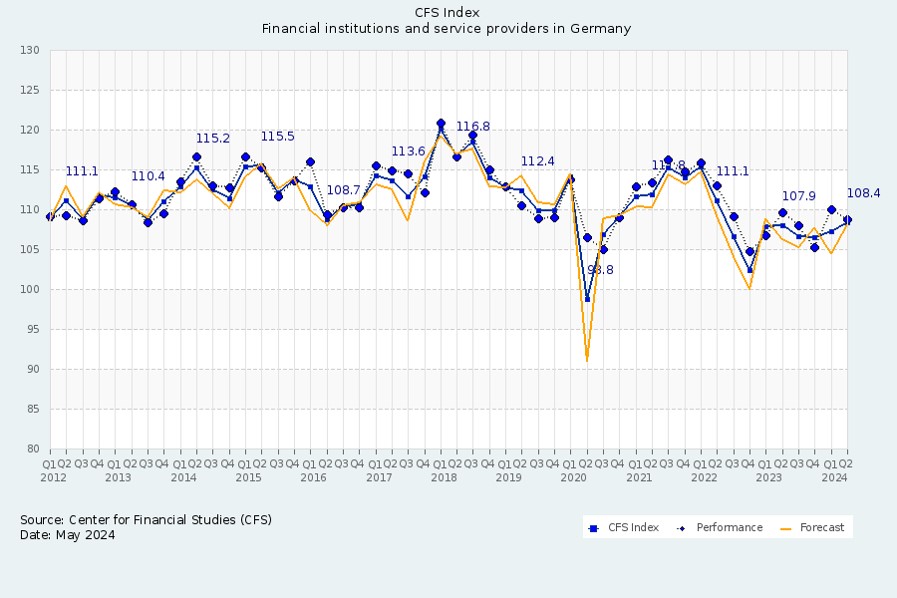

CFS Index

05.06.2024

CFS Index rises slightly

(Survey conducted 15-22 May 2024 for the results of the first quarter 2024)

The CFS Index, which tracks the sentiment of the German financial sector on a quarterly basis, rose by +1.2 points to 108.4 points in the first quarter of 2024. The financial sector as a whole reports good results for the first quarter in terms of growth in employee numbers. A significant recovery can be observed here compared to the previous year. Growth in the service providers’ investment volume has also increased. However, revenue and earnings growth across the entire financial sector declined in the first quarter. The service providers even report negative earnings growth, though they are optimistic for the current quarter, also with regard to revenue and investment volume.

“The relative stability of the index over the past six quarters is reminiscent of the pre-Covid-19 period,” comments Professor Andreas Hackethal, Director of the Center for Financial Studies.

The rating of the future international importance of the Financial Centre Germany rose significantly in the first quarter of 2024, based on the assessment of the service providers. With an increase of +7.6 points, the index now stands at 99.2 points and is approaching the neutral mark of 100 points again.

“The decision to locate the new EU anti-money laundering authority (AMLA) in Frankfurt has upgraded the financial center on the Main. And the coordinated cooperation between the federal government, the state and the city in the application for the AMLA has already shown that the financial industry in Germany enjoys strong support. Both of these factors are likely to have contributed to the increased assessment of the future importance of the financial center. It is now essential to resolutely seize the opportunities opened up by the AMLA in Frankfurt,” explains Gerhard Wiesheu, President of Frankfurt Main Finance.

Revenue and earnings growth for the entire financial sector down in the first quarter / Service providers even report negative earnings growth, but are optimistic for the current quarter

Revenue growth among the financial institutions fell by -1.6 points to 117.8 points in the first quarter of 2024, which is +7.4 points above the previous year’s level. The service providers also report a decline, in this case of -6.1 points to 102.2 points. Their revenue sub-index is now -13.6 points down on the previous year. The financial institutions’ expectations for the second quarter are on the pessimistic side, while the service providers anticipate a significantly better result than in the first quarter.

The surveyed financial institutions and service providers also report lower figures for earnings growth in the first quarter. The corresponding sub-index for the financial institutions slips by 2.3 points to 119.1 points and is +6.9 points above the previous year’s level. The sub-index for the service providers falls by -10.4 points to 99.1 points, dipping below the neutral level of 100 points for the first time since 2009. Compared to the prior year, it is down -7.5 points. The financial institutions have cautious expectations for the current quarter, while the service providers expect to achieve a better result.

Growth of the investment volume in product and process innovations among the financial institutions declines by -5.1 points to 104.5 points and is now practically at the previous year’s level (-0.1 points). The service providers indicate an increase of +4.9 points to 103.0 points. Their sub-index is now -7.9 points below the level of a year ago. The entire financial sector expects to see slightly higher growth in investment volume this quarter.

Growth in financial sector employee numbers has recovered significantly year-on-year

In contrast to the other sub-indices, the financial sector reports higher growth in employee numbers for the first quarter. The sub-index for the financial institutions climbs +2.5 points to 112.9 points and is well above the level of a year ago (+7.5 points). The service providers also register a substantial improvement of +5.2 points to 107.1 points. At +3.8 points, their sub-index is clearly above the previous year’s level. Taken as a whole, the financial sector expects to hire slightly fewer employees in the current quarter than in the first quarter.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.