CFS Index

28.10.2021

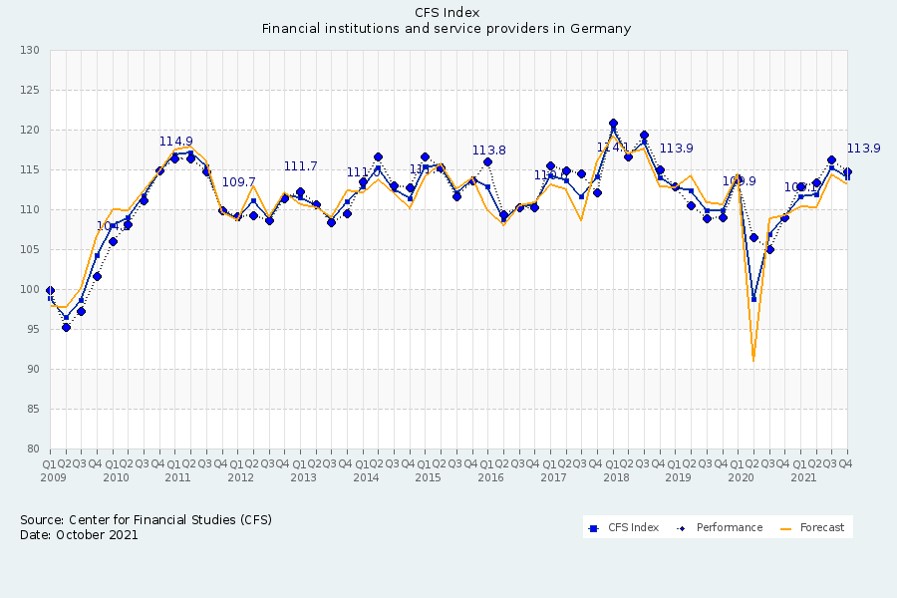

CFS Index takes a slight downturn

(Survey conducted 11 October – 18 October 2021 for the results of the third quarter 2021)

The third quarter has somewhat dampened the mood of the financial industry. The CFS Index, which measures the business climate of the German financial sector on a quarterly basis, falls -1.3 points to 113.9 points in the third quarter of 2021. Nevertheless, it shows a clear improvement of +4.8 points compared to the previous year’s level, indicating that the economy is recovering from the pandemic.

The downturn in the CFS index is mainly due to weaker growth in the revenues, earnings and investment volume of the service providers in the third quarter. For the fourth quarter, the financial institutions also anticipate a significant decline in their revenue and earnings growth, while the service providers expect to maintain the level of the third quarter. The financial institutions have positive news to report for the third quarter: they increase their earnings growth while maintaining constant growth in their revenues and investment volume. Growth in employee numbers at the financial institutions is also significantly above the previous year’s level. Looking at the current quarter, the financial sector expects to maintain its current level of workforce growth.

"The cyclical fluctuations in the index suggest that things are going ‘back to normal’. Yet the medium-term trend among the financial institutions is clearly positive, as evidenced by rising growth in investment and employee numbers, " comments Professor Rainer Klump, Director of the Center for Financial Studies.

Owing to the Covid crisis, the future international importance of the Financial Centre Germany is increasingly seen as on the decline. The corresponding value falls -7.1 points to 110.8 points and is now at its lowest level since 2012. This decrease is increasingly based on the assessment of the service providers. At 110.0 points, the relevant index value for this group is -11.1 points down on last quarter’s level. The assessment of the financial institutions falls -3.0 points to 111.6 points.

"As a result of Brexit, there was a massive wave of investment in Frankfurt, from which service providers in particular were able to profit. This wave is now coming to an end, as only a few new institutions are coming to Frankfurt. An end to the Corona restrictions should give new momentum to the relocation of business and jobs. Therefore, I remain optimistic", comments Gerhard Wiesheu, President of Frankfurt Main Finance.

Financial institutions increase earnings growth while maintaining level of revenue growth /

Service providers report lower revenue and earnings growth

As anticipated, the surveyed financial institutions report little change in the growth of their revenues/business volume in the third quarter. The corresponding index value falls just -0.1 to 123.0 points. For the service providers, on the other hand, the sub-index drops by -5.4 points to 118.1 points, yet remains +4.9 points above the level of one year ago. For the current quarter, the financial institutions expect a more noticeable decline in revenue growth, while the service providers expect to maintain their current level.

Earnings growth among the financial institutions increases by +6.8 points to 123.7 points in the third quarter. At +8.9 points, this is a significant gain over the previous year. By contrast, the service providers report a sharp decline of -7.9 points to 112.4 points. Nevertheless, this index value is +7.1 points above the level of a year ago. For the fourth quarter, the financial institutions hold distinctly modest expectations, while the service providers are only anticipating a slight decline.

Financial institutions maintain their growth in investment volume /

Service providers report a decline

Among the financial institutions, growth of the investment volume in product and process innovations increases by +0.6 points to 110.4 points, which is +5.9 points above the previous year’s level. Conversely, the service providers report a decline of -4.9 points to 108.2 points. Nevertheless, this value is up +4.6 points compared to a year ago. For the current quarter, the financial institutions expect to maintain the current level, while the service providers foresee a slight rise.

Financial institutions: employee growth clearly up on last year’s level

As expected based on the last survey, the financial institutions report growth in employee numbers for the third quarter. The corresponding sub-index rises by +2.2 points to 105.3 points and, at +13.0 points, is well above the level of a year ago, when job cuts were reported. The service providers also report slightly higher growth in their workforce. The relevant sub-index rises by +0.2 points to 108.2 points and, at +2.9 points, is also up on the previous year’s level. For the current quarter, both groups expect to maintain their present level of staff growth.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.