CFS Index

03.11.2022

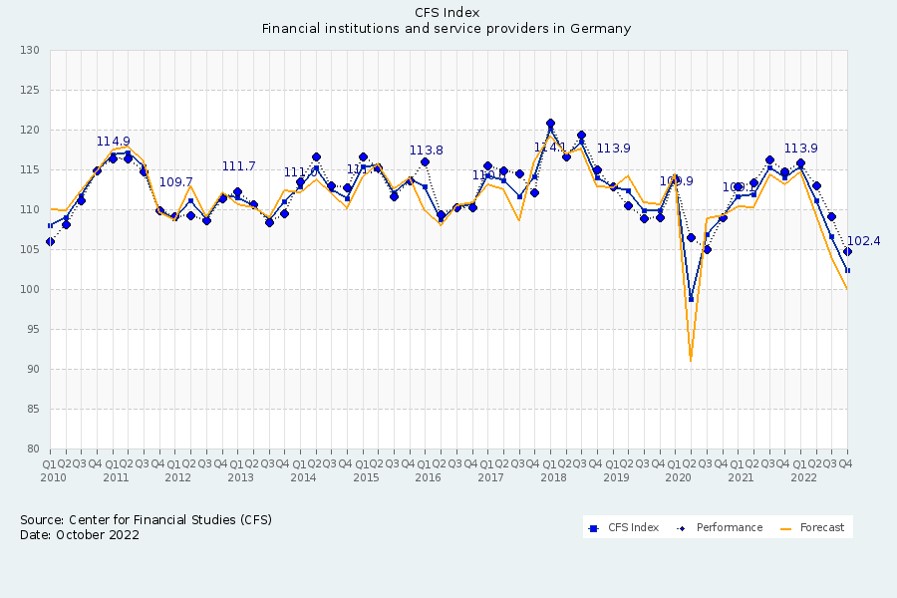

CFS Index remains on a downward trend

(Survey conducted 17 October – 24 October 2022 for the results of the third quarter 2022)

Sentiment in the financial sector has deteriorated for the third quarter in succession. The CFS Index, which measures the business climate of the German financial sector on a quarterly basis, falls by 4.3 points to 102.4 points in the third quarter of 2022. The value is down -11.6 points compared to the previous year. This is the lowest level since April 2020 and since the years 2008 and 2009, when sentiment fell to a negative value below the neutral level of 100 points.

The downward trend in the third quarter of 2022 is essentially driven by lower revenue and earnings growth across the entire financial sector and declining growth in employee numbers and investment volume among the service providers. By contrast, growth in the investment volume of the financial institutions has hardly declined. As in the last quarter, the financial sector as a whole has pessimistic expectations regarding growth in revenue, earnings and investment volume in the current quarter. The only encouraging news is slightly higher growth in employee numbers at the financial institutions. The service providers also expect to hire slightly more employees in the current quarter.

“Recession expectations in the real economy are now also having a massive impact on the financial sector,” comments Professor Rainer Klump, Director of the Center for Financial Studies.

The rating of the future international importance of the Financial Centre Germany continued to fall significantly in the third quarter. With a decline of -5.0 points, the current index value stands at 96.9 points. A negative value below the neutral level of 100 points has thus been reached for the first time since the index surveys began in 2007.

“The mood cannot leave us cold. It is nourished by several sources: war in Europe, persistently high inflation, energy crisis, risk of recession and interrupted value chains. This leads to a sentiment that is even worse than the current situation. Indeed, the stock market and banks have so far defied the crisis better than expected. The task now must be to embrace the crisis as an opportunity for positive, because faster, change toward greater sustainability in energy supply and supply chains,” says Gerhard Wiesheu, President of Frankfurt Main Finance.

Revenue and earnings growth of the financial sector clearly below last year’s level / Expectations of the financial sector pessimistic

As previously expected, revenue growth in the financial sector fell again in the third quarter of 2022. The financial institutions report a decline of -4.1 points to 106.6 points and are now -16.4 points below the previous year’s level. The sub-index for the service providers falls even more sharply, by -7.2 points to 104.6 points, and is -13.5 points below the level of a year ago. For the current quarter, the financial industry as a whole has even more pessimistic expectations.

Earnings growth in the financial sector has also fallen sharply. For the financial institutions, the corresponding sub-index sinks by -7.2 points to 105.4 points and is -18.3 points below the level of a year ago. For the service providers, the sub-index drops by -10.1 points to the neutral level of 100 points, which marks a year-on-year decline of -12.4 points. For the current quarter, both groups expect the sub-index to slip below 100 points, which represents a contraction in earnings.

Financial institutions report only slightly lower growth in investment volume

The growth of the investment volume in product and process innovations among the financial institutions declines marginally by -0.2 points to 108.3 points and is only slightly below the previous year’s level (-2.1 points). The service providers report a decline of -5.5 points to 101.9 points, which puts their sub-index -6.2 points below the level of a year ago. Both groups expect to see a further decline in the current quarter.

Slightly higher job creation among the financial institutions

As previously expected, the financial institutions report slightly higher growth in employee numbers for the third quarter. The sub-index rises by +0.9 points to 103.4 points and is -1.9 points below the level of the previous year. As in the last quarter, the service providers report a sharper decline in employee growth. Their sub-index drops by -5.1 points to 102.9 points and is -5.3 points below the level of a year ago. For the current quarter, the financial institutions anticipate a slight decline, while the service providers expect a slight upturn in job creation.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.