CFS Index

30.11.2023

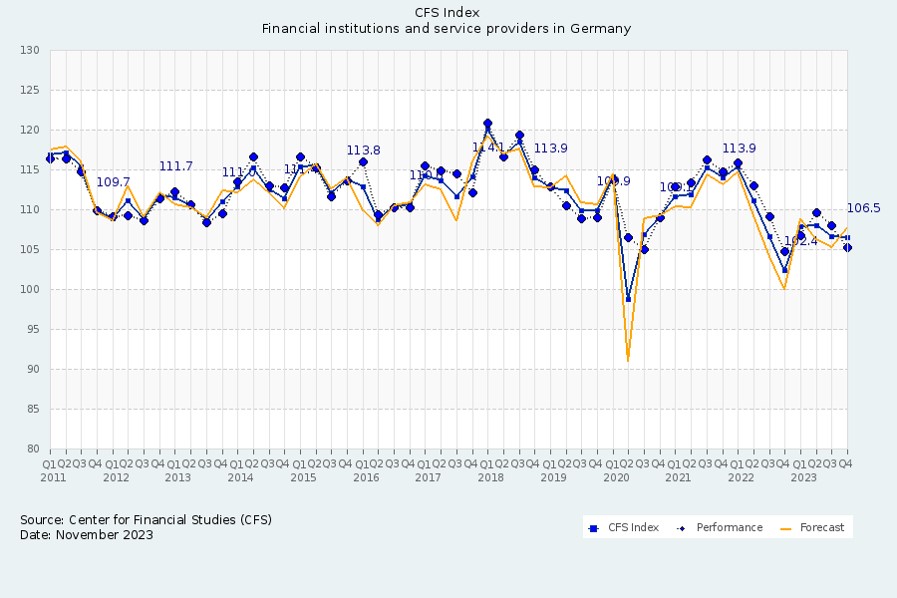

Optimistic expectations in the financial sector keep CFS Index level unchanged despite lower values in third quarter

(Survey conducted 13-20 November 2023 for the results of the third quarter 2023)

The CFS Index, which tracks the sentiment of the German financial sector on a quarterly basis, remains at 106.5 points, almost unchanged in the last quarter (-0.1 points). The financial sector as a whole reported a decline in revenue, earnings and workforce growth for the third quarter. Only the growth in investment volume increased, particularly among the financial institutions. However, expectations for the current fourth quarter are much more optimistic across the entire financial sector.

“The expectations of the surveyed institutions are starting to pick up again, contrary to the trend of rising refinancing costs and loan defaults,” comments Professor Andreas Hackethal, Director of the Center for Financial Studies.

The rating of the future international importance of the Financial Centre Germany fell dramatically again in the third quarter of 2023. With a drop of -6.0 points, the current level of 90.2 points is the lowest since the index surveys began in 2007. This assessment is shared by the financial institutions and service providers alike.

“The international standing of the financial centre is clearly better than the expectations for its future. Therefore, it is important that the city and state are now working with renewed vigour on the future viability of the financial centre. Above all, we need to make people who are new to the financial centre feel welcome and offer them attractive prospects,” explains Gerhard Wiesheu, President of Frankfurt Main Finance.

Financial sector reports lower revenue and earnings growth

Revenue growth among the financial institutions fell by -5.9 points to 108.9 points in the third quarter of 2023. This level still represents a rise of +2.3 points compared to the previous year. The service providers also reported a decline of -4.8 points to 104.5 points. This puts their revenue sub-index at the previous year’s level. Expectations for the whole financial sector are somewhat more optimistic for the fourth quarter.

Growth in financial industry earnings is also slowing. The corresponding sub-index for the financial institutions fell by -1.6 points to 116.8 points, but is still +11.5 points higher than one year ago. The earnings sub-index for the service providers declined by -1.7 points to 103.5 points, which is +3.5 points above the previous year’s level. For the current quarter, the financial institutions expect a slight downturn, while the service providers anticipate increased growth in earnings.

Higher growth in investment volume across the financial industry

Growth of the investment volume in product and process innovations among the financial institutions climbs +5.1 points to 110.0 points and is now +1.7 points higher than the previous year’s level. The service providers also reported an increase of +2.0 points to 102.0 points, which is the same level as a year ago. For the current quarter, the financial institutions expect investment growth to decline, while the service providers anticipate an increase.

Service providers make significant job cuts but are optimistic for the fourth quarter

As with other sub-indices, the financial institutions reported lower growth in employee numbers. The sub-index fell by -1.7 points to 106.1 points, but is still +2.7 points above the previous year’s level. The service providers also recorded a decline. The employee numbers sub-index dropped by -4.5 points to 94.9 points, which reflects substantial job cuts. At -7.9 points, the sub-index is also well below the previous year’s level. The financial institutions hardly anticipate any change in the current quarter. The service providers are optimistic that they can stop cutting jobs in the fourth quarter and start hiring again.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.