CFS Index

11.05.2023

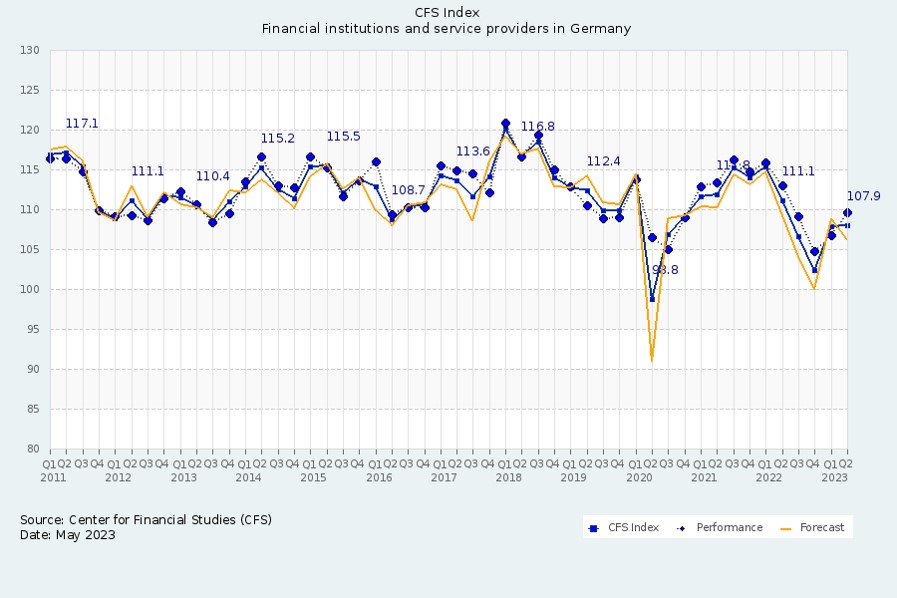

Contrasting sentiment among financial institutions and service providers keeps CFS Index at unchanged level

(Survey conducted 24 April – 2 May 2023 for the results of the first quarter 2023)

Sentiment in the financial sector has shown contrasting trends in the first quarter of 2023. However, the CFS Index, which measures the business climate of the German financial sector on a quarterly basis, remains virtually unchanged at 107.9 points, just +0.1 points up on the previous quarter. Sentiment among the financial institutions deteriorated by -4.0 points, whereas it improved by +4.2 points among the service providers.

The contrasting sentiment reflects declines in the growth of revenues, employee numbers, and investment volume reported by the financial institutions in the first quarter. However, earnings growth at the financial institutions increased. The service providers report a far more positive overall trend for the first quarter. In particular, revenue and earnings growth increased, as did growth in investment volume. For the current second quarter, expectations for the financial sector as a whole are more subdued. Only the financial institutions expect a slight increase in investment growth.

“Both the current business situation and the outlook are thus largely unaffected by the recent shocks at mid-sized US banks and at Credit Suisse,” comments Professor Andreas Hackethal, Director of the Center for Financial Studies.

The rating of the future international importance of the Financial Centre Germany increased significantly in the first quarter of 2023, based on the assessment of the financial institutions. The index value rises by +3.7 points to 101.0 points, which brings it back above the neutral level of 100 points.

“The return of the index to the growth range is quite welcome. However, the development of the past years shows that the stakeholders of the financial centre must continue to make an effort. As is well known, competition never sleeps - as shown by the latest settlement decisions in Paris,” says Gerhard Wiesheu, President of Frankfurt Main Finance.

Financial institutions: revenue growth falls, earnings growth rises / Service providers: revenue and earnings growth rises significantly again

The revenue growth of the financial institutions decreased by -1.5 points to 110.4 points in the first quarter of 2023, but is only -2.0 points below the level of the previous year. By contrast, the service providers report a huge increase of +12.0 points to 115.8 points. However, this sub-index still remains -3.0 points below the level of a year ago. For the second quarter, the expectations of the financial sector are somewhat more subdued.

The surveyed financial institutions and service providers give positive responses on earnings growth. The corresponding sub-index of the financial institutions rises by +2.3 points to 112.2 points and is now +6.0 points above the level of the previous year. For the service providers, the sub-index rises by +14.1 points to 106.6 points and is now only -8.8 points below the level of the previous year. Three months ago, the sub-index of the service providers was at its lowest level since 2009. For the current quarter, both groups anticipate a slight decline.

The two groups reveal opposing trends in the growth of investment volume

Growth of the investment volume in product and process innovations among the financial institutions falls by -4.5 points to 104.6 points and is now -10.3 points below the previous year’s level. The service providers report an increase of +7.6 points to 110.9 points, which means this sub-index is +5.8 points above the level of a year ago. For the current quarter, the financial institutions expect a slight increase, while the service providers anticipate significantly lower growth in investment volume.

Job creation at the financial institutions at previous year’s level / Service providers significantly lower

The financial institutions report lower growth in employee numbers for the first quarter. The corresponding sub-index falls by -4.7 points to 105.3 points and is in line with the previous year’s level at +0.2 points. The service providers report that growth in their workforce has increased slightly by +0.9 points to 103.3 points, yet remains clearly below the previous year’s level at -13.2 points. Looking at the current quarter, the financial institutions expect to hire fewer employees, while the service providers plan to maintain the same level.

We would like to thank Frankfurt Main Finance e.V. for financially supporting the project.