CFS Index

Der CFS-Index bildet die Urteile und Erwartungen von Schlüsselpersonen des Finanzstandortes Deutschland ab. Sein Ziel ist es, die jeweils aktuelle Stimmungslage zu Entwicklungschancen und -risiken des Finanzplatzes und deren Veränderung im Zeitverlauf zu erfassen.

Der Index wird seit Anfang 2007 erhoben. Während der Erhebung zunächst nur eine Befragung von Unternehmen und Institutionen aus der Rhein-Main-Region zugrunde lag, wurde die Umfrage Ende 2007 auf ganz Deutschland ausgeweitet. Die Panelteilnehmer werden in die Sektoren „Finanzinstitute“ und „Dienstleister“ unterteilt:

- Finanzinstitute

Als Nukleus des Finanzplatzes bilden Banken und Versicherungen sowie Investmentgesellschaften und verwandte Institutionen die erste Gruppe. - Dienstleister

Um diesen Nukleus herum gruppieren sich unterschiedlich spezialisierte Dienstleistungsunternehmen, die für Finanzinstitutionen, aber auch für Unternehmen anderer Branchen tätig sind. Beispiele sind Rechtsanwaltskanzleien, Wirtschaftsprüfer oder Nachrichtenagenturen.

Weitere Teilnehmer dieser Gruppe sind Aufsichts- und Regulierungsbehörden wie z. B. die Deutsche Bundesbank oder die Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) sowie Interessenverbände und Bildungseinrichtungen.

Darüber hinaus gibt es eine Reihe von Unternehmen, die von Finanzplätzen wie Frankfurt oder München profitieren, wie z. B. Fluggesellschaften, Hotels, Luxus-Autohändler oder Catering-Unternehmen.

Ausblick

Das CFS strebt an, den CFS-Index als Frühindikator für die konjunkturelle Entwicklung der Finanzindustrie in Deutschland zu etablieren. Dieser Wirtschaftszweig wird von anderen Indikatoren wie dem ifo-Geschäftsklimaindex oder den ZEW-Konjunkturerwartungen nicht erfasst, obwohl er sehr bedeutend für die deutsche Wirtschaftsentwicklung insgesamt ist.

Aktuelle Erhebung

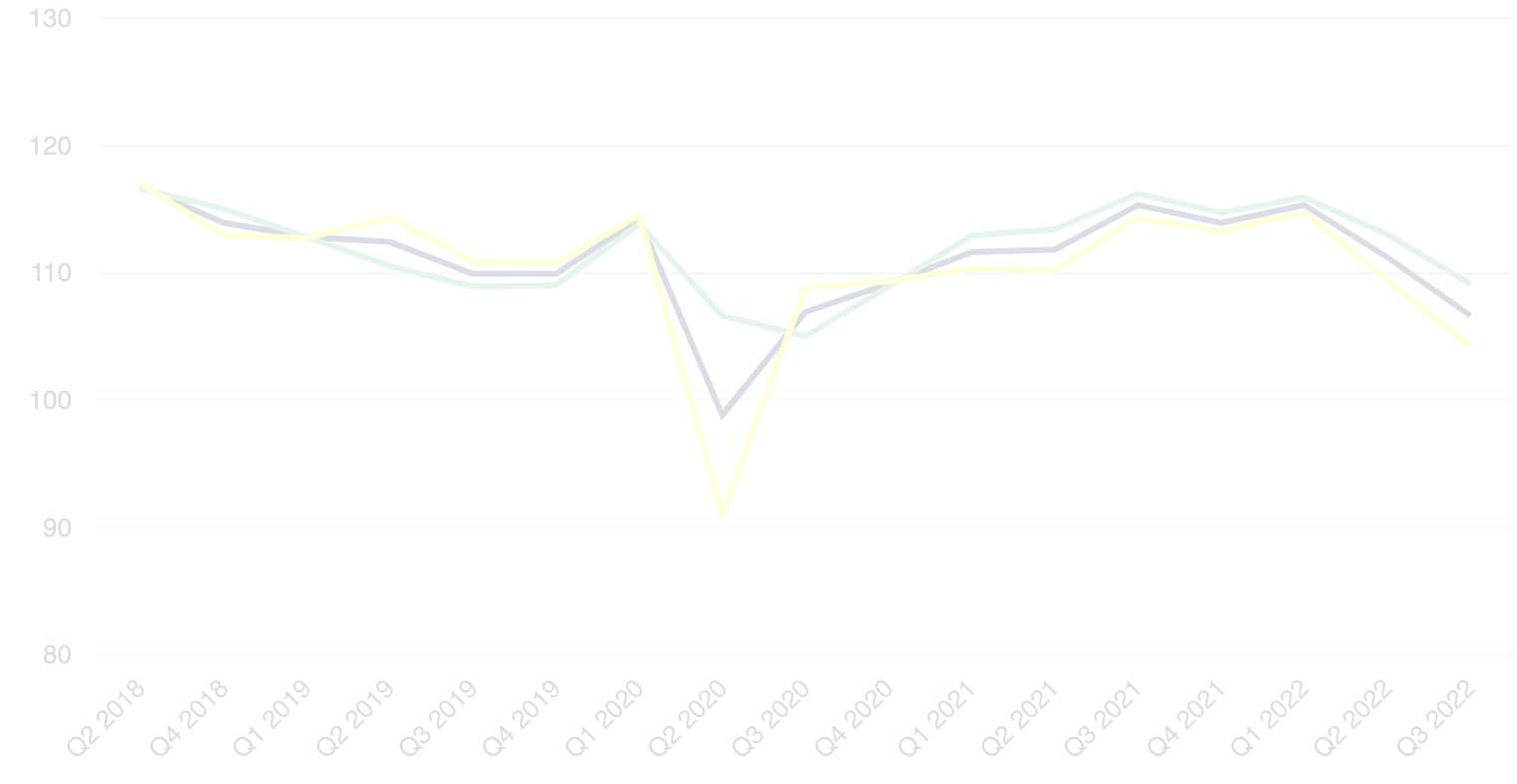

The CFS Index Chart uses technologies from Google. To view the chart, click the button below and confirm the use of external media in the privacy settings.

Vergangene Erhebung

Berechnung

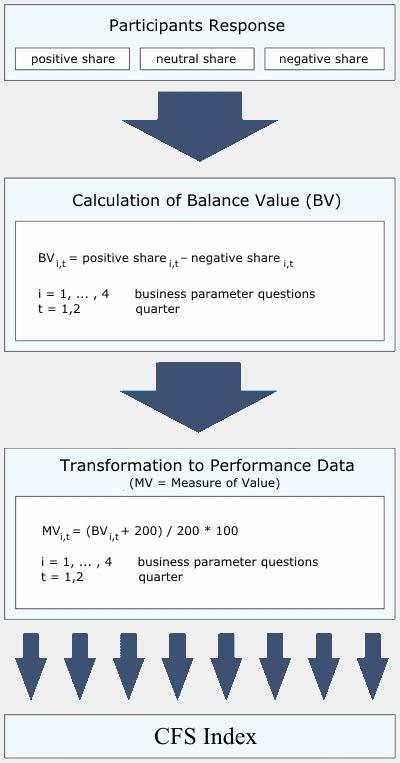

Der CFS-Index setzt sich aus verschiedenen Subindizes zusammen. Die Panelteilnehmer erhalten Fragen zu vier Unternehmenskennzahlen – Geschäftsvolumen, Ertragssituation, Mitarbeiterzahl und Investitionssumme –, die sie sowohl für das abgelaufene als auch für das jeweils kommende Quartal mit “positiv”, “neutral” oder “negativ” beantworten können.

Die Panelteilnehmer sind in zwei Gruppen unterteilt. Innerhalb jeder Gruppe werden Salden aus den Anteilen der positiven und den Anteilen der negativen Antworten gebildet und in Messzahlen transformiert. Diese Messzahlen werden zusammengefasst und konstituieren den CFS-Index. Konstruktionsbedingt beträgt der maximale Indexwert 150, der minimale 50; ein Wert von 100 signalisiert eine neutrale Stimmungslage.

Partner